idaho tax refund schedule 2021

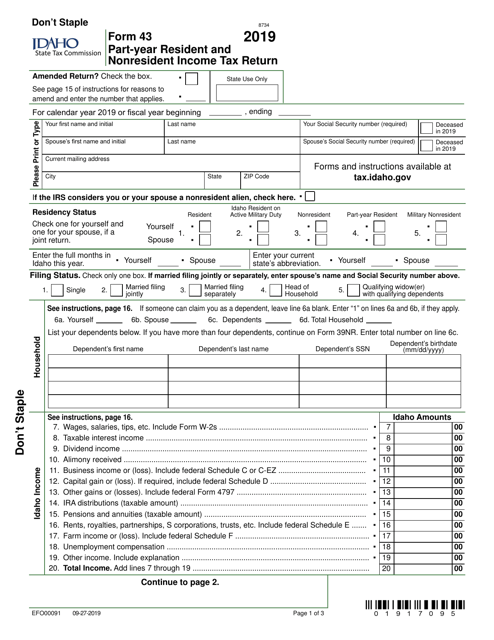

Online worksheet is used now - form is outdated. Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Idahoans To Start Getting Income Tax Rebate Payments This Month Idaho Bigcountrynewsconnection Com

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

. You can prepay at any time at taxidahogovepay or by mailing your payment with Form 51. The Idaho State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Mailed in paper refunds can take up to 10 weeks to complete processing.

File your return and pay any tax due. For paper filing it can take up to 10 weeks for your refund to complete processing. The personal exemption was eliminated starting in the 2019 tax year just as they were.

Brad Little signed house bill 380 which created the 2021 Idaho Tax Rebate. State income tax refund if included in federal income. The standard deduction is equal to the federal standard deduction which for the 2021 tax year is 12550 for single filers and 25100 for joint filers.

Any remaining amount will be refunded to you. Find IRS or Federal Tax Return deadline details. Idaho State Income Taxes for Tax Year 2021 January 1 - Dec.

In May Gov. The Idaho tax rate is unchanged from last year however the income tax brackets. US News Idaho Tax Rebate 2022.

About 70000 payments will be issued every week. 2 in order of the dates they received the 2020 tax filings. We last updated Idaho Form 75-BST in March 2022 from the Idaho State Tax Commission.

The Idaho tax filing and tax payment deadline is April 18 2022. We must manually enter information from paper returns into our database. How will I receive my rebate payment.

By April 18 2022 for the 2021 calendar year or By the 15th day of the fourth month following the close of the fiscal year if you file on a fiscal year basis Idaho doesnt require estimated tax payments. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ID state return. But it is still likely to be more than the 2021 refunds.

This form is for income earned in tax year 2021 with tax returns due in April 2022We will update this page with a new version of the form for 2023 as soon as it. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return. According to Idaho State Tax Commissions website you can expect to receive your refund in about 7 weeks from the date you receive your state acknowledgement for e-filing.

You can expect your refund about 10 to 11 weeks after we receive your return. 2020 who filed an individual income tax return or a grocery credit refund according to the tax rebate. Form 40 Individual Income Tax Return 2021 approved Author.

See instructions page 27. Due to the pandemic the IRS automatically extended the federal tax-filing and tax-payment deadlines to July 15 2021. Taxpayers who provided valid bank information when filing their 2021 tax returns will receive.

To track the status of your Idaho. If you owe more than the amount of your rebate youll receive a statement in May showing the amount due. Individual Income Tax Rate Schedule taxidahogovindrate For years.

2021 Tax Refund Schedule 2020 Tax Year The IRS 2021 tax season 2020 tax year was scheduled to begin Feb. TaxFormFinder provides printable PDF copies of 66 current Idaho income tax forms. Well apply your rebate to your 2021 tax after weve processed all payments received in April.

Idaho income tax withheld. Idaho State Tax Commission states on their website that electronically filed refunds process in about 7 weeks. See instructions page 53.

Idaho State Tax Commission PO Box 56 Boise ID 83756-0056 Include a complete copy of your federal Form 1120. See page 1 of the instructions for reasons to amend and enter the number that applies. Idaho State Tax Commission officials will begin to process payments on Monday Aug.

Wages earned in another state that has an income tax such as Oregon or Utah while youre living in Idaho Income from a business or profession earned in another state that has an income tax while youre a resident of Idaho Line 23 Total Credits for Charitable. Tax from tables or rate schedule. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012.

Can your tax refund be deposited on Sunday. The Idaho Department of Revenue is responsible for publishing the latest Idaho State. Httpstaxidahogovi-1043cfm We last updated the Idaho Grocery Credit Refund in January 2022 so this is the latest version of FORM 24 fully updated for tax year 2021.

EFO00025 10-21-2021 Page 1 of 2 Dont Staple Form 41 Corporation Income Tax Return 2021 Amended Return. Which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not. Idaho fuels tax refund worksheet Form 75-BST - Idaho Fuels Tax Refund Worksheet Idaho Consumers with Bulk Storage Tanks F O R M EFO00050 75-BST 06-06-2016 IDAHO FUELS TAX REFUND WORKSHEET Idaho Consumers with Single or Multiple Bulk Storage Tanks Use this worksheet ONLY IF you use Idaho tax-paid motor fuel from bulk storage tanks in Idaho in.

Resident Supplemental Schedule 2021 approved Extracted from PDF file 2021-idaho-form-39rpdf. EIN00046 11-15-2021 2021 continued Examples of income that may be taxed by both Idaho and another state include. You can download or print current or past-year PDFs of FORM 24 directly from TaxFormFinder.

HB 1302 Tax Refund Schedule. Resident Supplemental Schedule 2021 Names as shown on return Social Security number A. Idaho has a state income tax that ranges between 1125 and 6925 which is administered by the Idaho State Tax Commission.

To track the status of your Idaho 40 income tax refund online visit the Idaho State Tax Commission website and use their Wheres My Refund service. Special fuels tax refund Gasoline tax refund Include Form 75. Idaho tax Form 40 line 20.

Download or print the 2021 Idaho FORM 39R Idaho Supplemental Schedule Resident for FREE from the Idaho State Tax Commission.

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho Tax Rebate 2022 When Can You Expect Your Idaho Tax Refund Marca

Where S My Refund Idaho H R Block

One Time Tax Rebate Checks For Idaho Residents Klew

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Have You Sent Your Idaho Tax Return But Haven T Received A Refund This Could Be Why East Idaho News

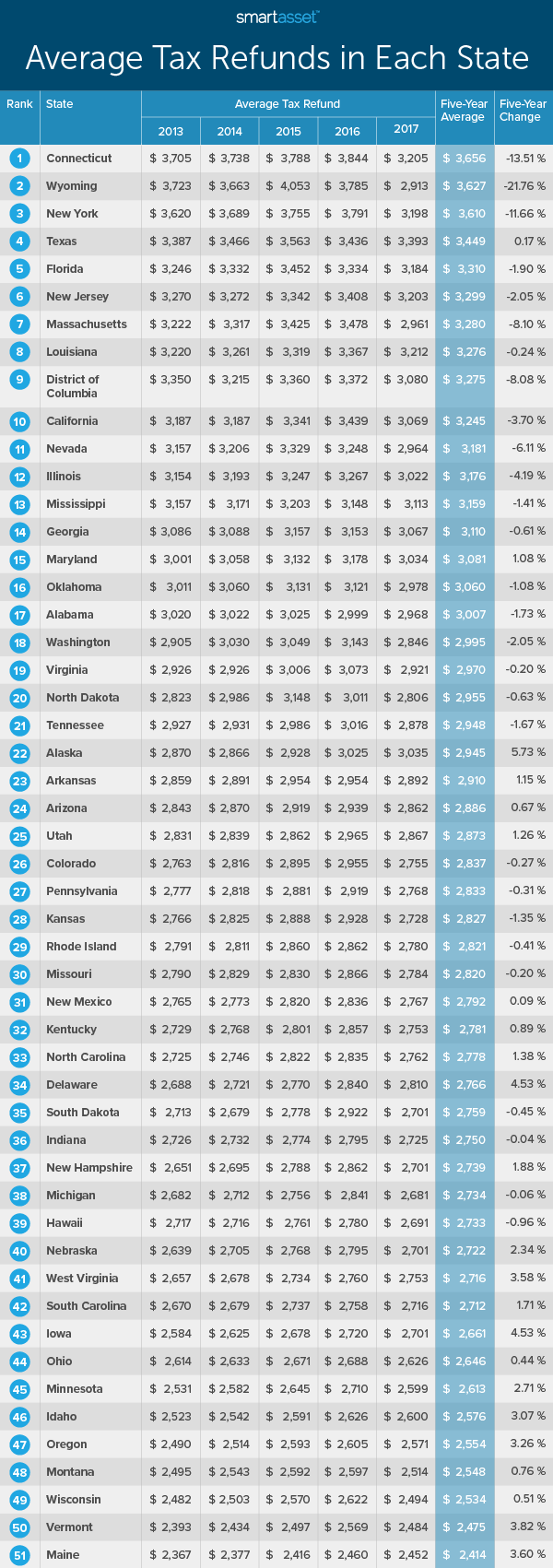

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Idaho Tax Forms And Instructions For 2021 Form 40

Prepare And E File 2021 Idaho State Individual Income Tax Return

Idaho Income Tax Rates For 2022

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund

One Time Tax Rebate Checks For Idaho Residents Klew

Idaho Residents Start Seeing Tax Relief Money

Where S My Idaho State Tax Refund Taxact Blog

Here S The Average Irs Tax Refund Amount By State

Tax Refunds In America And Their Financial Cost 2020 Edition Smartasset